Basics

- Address: Ransome’s Warf, London SW11 4SR, UK

- Status: New Launch!

- Category: For sale

- Type: Apartments

Description

-

Description:

Ransome’s Wharf, SW11 4NP: Low-Rise Riverside Luxury Opposite Chelsea Embankment

Ransome’s Wharf, a signature new development, offers a truly exceptional living and investment opportunity in Battersea. Its location is prime riverside, granting residents a private view directly across the Thames to the timeless elegance of Chelsea Embankment. This is not simply a property; it is an exclusive gateway to one of London‘s most sought-after waterfront positions.

This prestigious mixed-use scheme deliberately moves away from high-density urban living. Instead, it features just five elegant blocks of low-rise apartments. Consequently, the design prioritises human scale, light, and space. The apartments are carefully set within beautiful landscaped gardens, which delivers a highly desirable, tranquil riverside experience that feels genuinely secluded.

Investment and Unit Excellence: Quality

The development’s structure is inherently attractive to long-term investors. It comprises a total of 118 stylish homes. Of these, 94 are premium apartments for private sale, offering a superb range of one-, two-, three-, and four-bedroom layouts. Furthermore, there are 24 high-quality affordable homes, ensuring a diverse and inclusive community, which supports neighbourhood stability.

Indeed, the attention to resident comfort is clear. Every single apartment benefits from its own private amenity, whether a balcony, terrace, or direct garden access. Moreover, the internal layouts are generously proportioned, exceeding the latest London Housing Design Guide standards. This superior design quality, including extensive family-sized affordable options, underpins the asset’s value and rental appeal.

Location Intelligence: Connectivity and Lifestyle

Clearly, the Battersea location drives demand. Residents are steps away from the expansive green space of Battersea Park. Additionally, the Ransome’s Wharf is ideally situated near boutique shopping, restaurants, and cultural venues. This provides a complete, seven-day-a-week lifestyle, which is crucial for tenant attraction and retention.

Consequently, transport links are exceptional. Residents have access to nearby rail stations and the unique convenience of the Thames Clipper riverboat services. This connectivity offers rapid access to key central employment hubs like the West End and Canary Wharf. Therefore, the area is highly appealing to affluent young professionals seeking value without sacrificing central access.

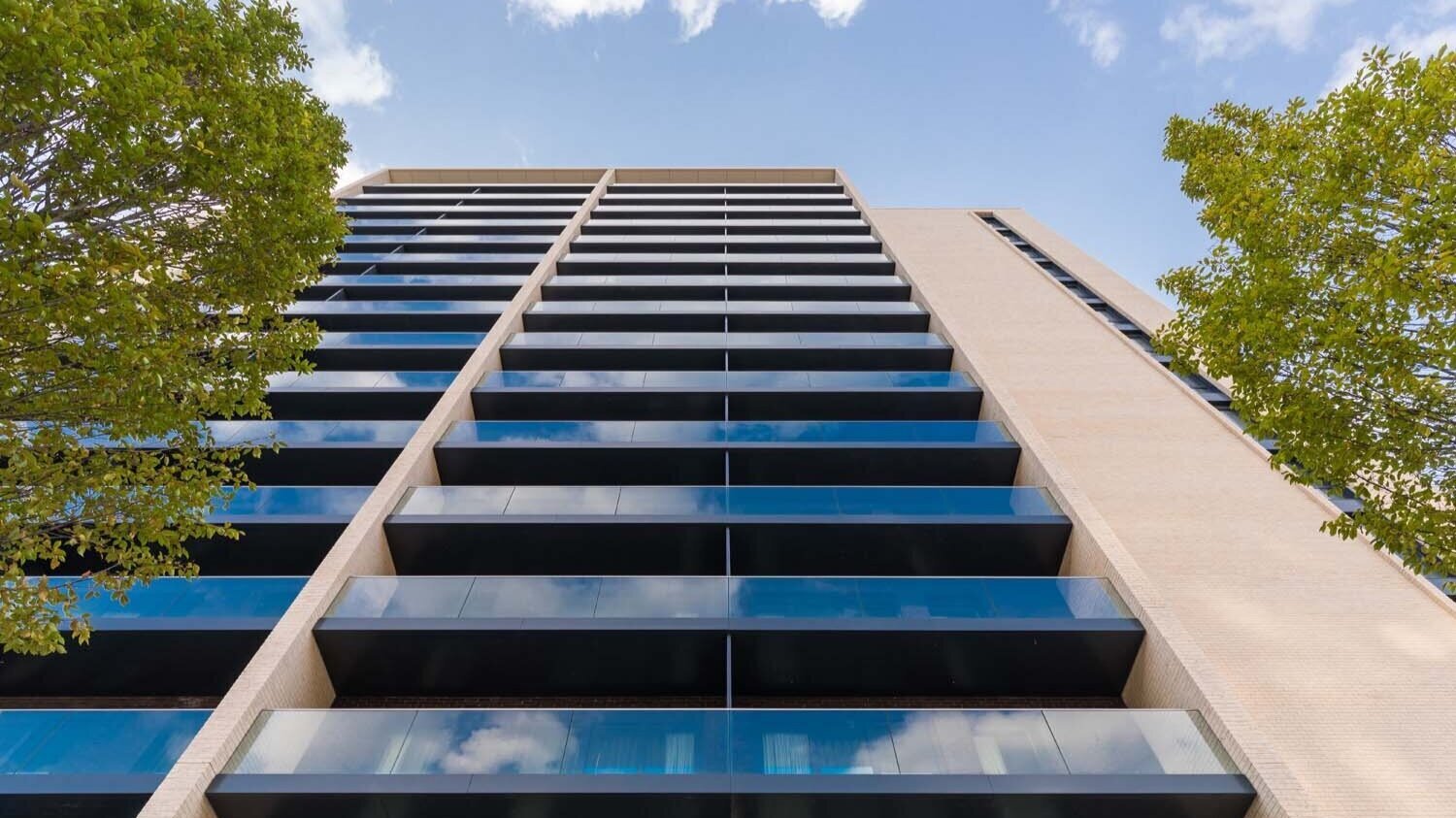

In addition, the proximity to the spectacular Battersea Power Station’s shops and leisure facilities ensures ongoing neighbourhood value uplift. The stylish design, which is inspired by traditional dockside warehouses and features quality brickwork, further secures the scheme’s long-term aesthetic appeal in this rapidly regenerating zone.

Investment Opportunity: Market Dynamics and Key Drivers

Battersea‘s investment strength lies in its exceptional rental performance. The high density of premium, amenity-rich stock, combined with NLE access, has led to rental values outperforming traditional PCL areas, making it a compelling choice for income-focused investors.

Key Investment Drivers: Yield vs. Appreciation

Outperforming Rental Yields

Gross rental yields in the area commonly range from 3.1% to 5.1%. This is significantly higher than the 2.5-3.4% typical in traditional Prime Central London (PCL). This market dynamic offers a superior income-focused return.

Capital Upside from Regeneration: Capital appreciation upside of up to 30% post-completion is projected in the regeneration zone, offering strong potential for confirmed capital growth.

Strategic Corporate Demand

The proximity to corporate tenants, notably from the new battersea”>Apple headquarters, underpins robust and long-lasting tenancy. This creates demand for executive tenancy and low vacancy risk, which is crucial for income-focused portfolios.

PCL Discount & Convergence: Despite the premium finish, Nine Elms/BPS remains valued at a discount (approx. 24% lower) compared to traditional PCL areas like Chelsea. This price gap means there is substantial future capital growth potential as values converge across the region.

Frequently Asked Questions (FAQ) for Investors

Q: What is the estimated completion date for Ransome’s Wharf?

A: Please contact the sales team directly for the latest phase completion and handover schedule, as these dates are subject to construction progress.

Q: What is the primary investment thesis for this development?

A: The thesis is centred on long-term capital appreciation and secure rental demand, driven by the low-density, riverside location, high-quality build, and proximity to major employment and leisure hubs.

Q: Are there any immediate rental voids expected?

A: The professional, institutionally managed nature of the build-to-sell apartments, coupled with the exceptional amenity package, is designed to minimise void periods and ensure robust income collection from the outset.

Investor Highlights

- Investor information: Ransome’s Wharf is a secure, prestigious investment driven by its irreplaceable riverside location opposite Chelsea, superior low-rise design, institutional developer quality, and high capital growth potential over immediate cash-flow yield.

Location

Connectivity

- Connectivity: Exceptional connectivity is secured by proximity to rail stations and the scenic Thames Clipper riverboat service, offering rapid and convenient access to Central London, including Canary Wharf, and excellent local permeability.

Local Amenities and Education

- Schools: The nearest top-tier schools include the prestigious independent Thomas’s Battersea (former school of Prince George and Princess Charlotte), high-achieving co-educational independent Emanuel School, and Ofsted ‘Outstanding’ state schools such as Chesterton Primary School and Harris Academy Battersea.