Basics

- Address: White City

- Status: Ready to move-in

- Category: For sale

- Prices from: £665,000

- Accommodation: 1, 2, 3 and 4 bedroom homes

Description

-

Description:

The opportunity to acquire a luxury new build residence within White City represents arguably the most compelling property investment opportunity in West London today. This highly desirable Zone 2 location, already benefitting from a colossal £8 billion regeneration initiative, is now home to a collection of superb residences with a rare blend of outstanding connectivity and world-class private amenities. The initial price point, starting from just £665,000, positions these homes as an exceptionally liquid asset class that is primed for capital appreciation. This is not merely a residential development; it is an investment in London‘s future growth corridor, meticulously crafted by leading developers to cater to the discerning international buyer and the high-calibre corporate tenant.

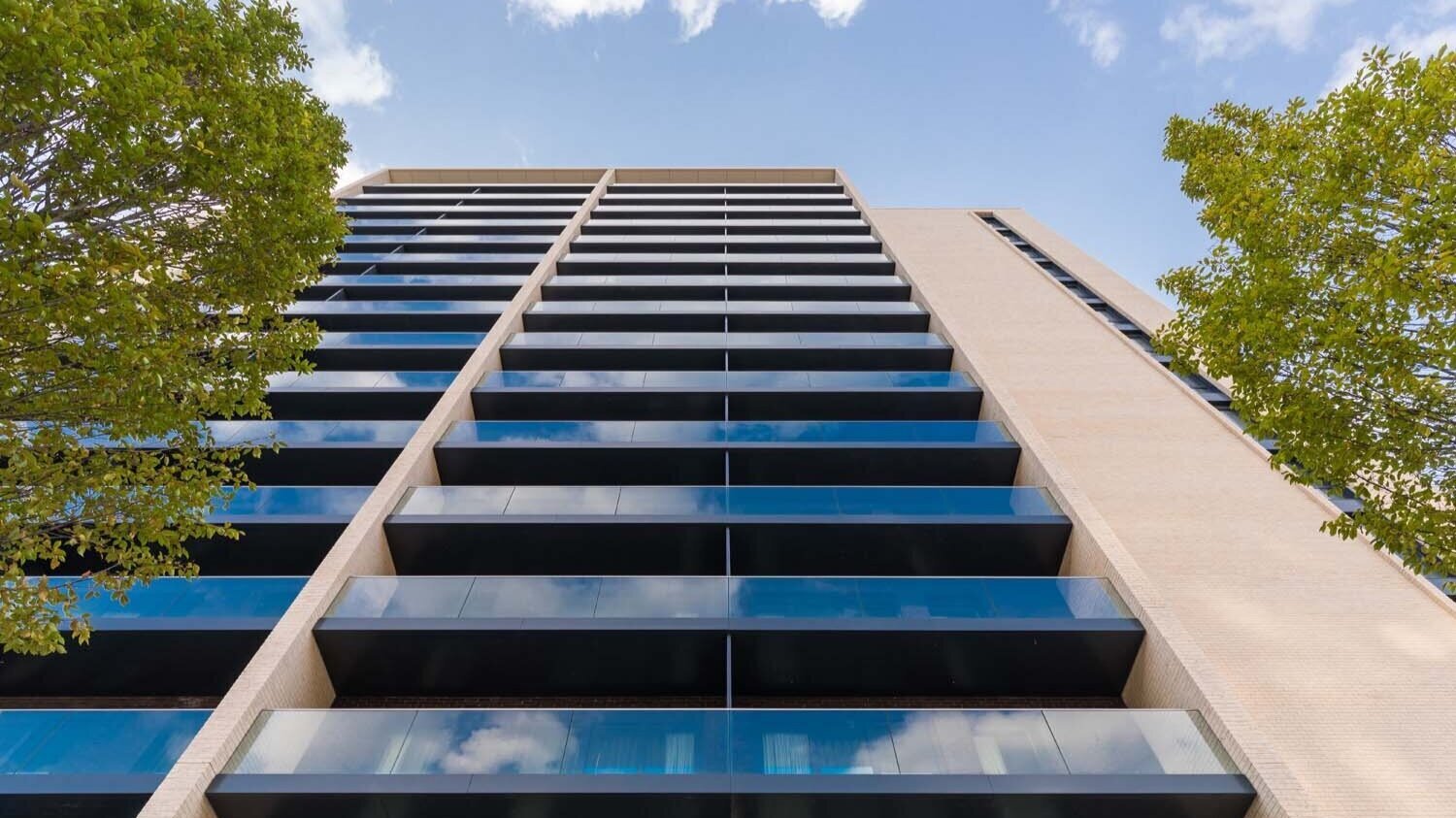

White City‘s architectural vision is one of seamless modernity, a distinctive urban renewal project that effortlessly integrates sleek, contemporary design with generous green spaces and a dynamic cultural hub. The residences themselves offer curated palettes and exceptional internal specification, ranging from efficient one-bedroom pied-à-terre options to expansive two, three, and even four-bedroom family homes. The thoughtful unit mix ensures wide market appeal, featuring layouts that prioritise generous reception spaces, sophisticated en-suite bathrooms, and in the larger homes, dedicated dressing areas. Every detail, from the selection of premium materials to the floor-to-ceiling windows, has been engineered to maximise natural light and create an environment of tranquil luxury in the heart of the city. This approach to architectural style guarantees that whether an owner is seeking a primary residence or a strong buy-to-let asset, the property will stand out for its design quality and enduring appeal.

A hallmark of this development is the sheer scale of the private facilities, comprising 39,000 sq ft of world-class residents’ amenities. This is the ultimate expression of the boutique scale lifestyle offering. The Residents Home Club serves as a true extension of the home, providing everything a resident might need for fitness, relaxation, and socialising. Facilities include a substantial swimming pool, a full-service spa complete with treatment rooms, and a state-of-the-art gymnasium. For entertainment, the communal spaces feature sophisticated private lounges, a dedicated cinema room for movie screenings, and co-working spaces ideal for flexible working. The 24-hour concierge service ensures seamless, secure, and supported living, offering everything from package management to travel arrangements. Regarding building spec, all units are held on a secure leasehold tenure with a lengthy lease, offering complete peace of mind, and the entire scheme benefits from comprehensive security measures, including secure parking provisions and controlled lift access, essential features for the international or second-home owner. Furthermore, the commitment to sustainability means the development maintains high energy efficiency ratings, a key factor for reducing running costs and appealing to modern tenants.

Prices from £775,000

- 39,000 sq ft of world class residents’ facilities

- Residents Home Club includes concierges, lounges, cinemas and pools

- Excellent transport links just 12 minutes to Bond Street

- Moments from Notting Hill, Holland Park and Kensington

- Next door to Westfield London, Europe’s largest shopping centre

- Gateway to Imperial College London’s new 23-acre campus

White City is fast becoming one of London’s top investment hotspots, fuelled by £ billions in regeneration, strong rental yields, and rising property values. With world-class transport, high tenant demand, and premium developments, it offers a prime opportunity for investors seeking both income and long-term growth.

The hyperlocal environment of White City has transformed it into a premier West London destination. It is a genuine cultural hub, sitting moments from the historic charm and artistic vibrancy of Notting Hill and the leafy prestige of Holland Park and Kensington. This premium adjacency makes the area immensely appealing to wealthy residents who seek Central London connectivity without sacrificing local neighbourhood atmosphere. The unparalleled retail experience offered by Westfield London, Europe’s largest shopping centre, is directly adjacent, offering access to hundreds of shops, restaurants, and entertainment venues. Crucially, White City is also the gateway to Imperial College London’s massive new 23-acre innovation campus. This anchor institution drives immense demand, creating a ready supply of high-calibre corporate tenants, academics, and researchers who require premium rental accommodation, thereby underpinning the strong rental yield figures. For those interested in family life, the proximity to a selection of top-rated schools and local parks enhances its appeal, ensuring a balanced and supported community environment.

The development boasts truly prime transport links, making rapid connections a reality for residents and ensuring high convenience for foreign ownership. The area is exceptionally well-served by the London Underground, specifically the Central, Circle, and Hammersmith & City lines, providing seamless access across the capital. Key journey times are verified and impressive: the financial and luxury retail heart of the city, Bond Street, is just 12 minutes away, while King’s Cross St Pancras is accessible in around 20 minutes, offering vital connections to the Eurostar international terminal. For global travellers, the A40 arterial route provides a direct link to Heathrow Airport, making this a perfect pied-à-terre location for frequent international business travellers. This connectivity profile is a significant non-negotiable factor for both corporate rental agreements and end-users alike, cementing the area’s rental demand profile.

From an investment opportunity standpoint, White City is one of London‘s standout performers. The immense and ongoing £8 billion regeneration has already demonstrated its power in driving historical outperformance in capital appreciation compared to many established PCL (Prime Central London) areas. Our analysis confirms projected net rental yields averaging 4-5% p.a., combined with a compelling Compounded Annual Growth Rate (CAGR) of 5-7%. The high liquidity of assets in this area is a direct result of the strong demand from the resident corporate tenants and international students linked to Imperial College. For the discerning buy-to-let investor, the promise of one-bedroom units achieving rental figures upwards of £2,400 per month coupled with minimal void periods makes this a superior financial proposition. This ongoing regeneration trajectory guarantees sustained future value uplift, solidifying the investor’s long-term position. The investment case is clear: acquire high-specification residential property in a rapidly institutionalising knowledge and business hub.

Development, located in West London, has undergone a remarkable transformation in recent years, emerging as a highly attractive proposition for property investors. The extensive regeneration, strategic positioning, and robust infrastructure developments have significantly enhanced the area’s desirability, making it a compelling investment opportunity. With leading developers such as the Berkeley Group driving the growth of luxury residential schemes, White City now offers a mix of high-end homes, modern commercial spaces, and world-class amenities that underpin its long-term value proposition.

The area’s regeneration has been backed by approximately £8 billion in investment, leading to a sweeping urban renewal that has transformed White City from a historically industrial and media-driven district into a vibrant, modern residential and business hub. Developments such as the revitalisation of the BBC Television Centre, now offering 950 new homes alongside premium office space, have played a pivotal role in reshaping White City’s landscape. The influx of high-end retail, hospitality, and corporate headquarters has further reinforced its standing as a key growth area within London’s evolving property market.

White City’s location within Zone 2 is a major advantage, offering seamless connectivity to central London and beyond. The area is served by multiple Underground lines, including the Central, Circle, and Hammersmith & City lines, which provide swift access to key financial and commercial districts. Bond Street can be reached in around 12 minutes, and King’s Cross St Pancras in approximately 20 minutes, making it an ideal location for professionals who require fast links to London’s key employment hubs. The A40 arterial route further enhances accessibility, providing a direct connection to Heathrow Airport and the wider motorway network, a crucial factor for both business travellers and overseas investors.

The presence of premier retail and leisure facilities in White City has been instrumental in driving property demand. Westfield London, the largest covered shopping centre in Europe, is located at the heart of the district, offering over 450 shops, restaurants, and entertainment venues. The area has also become a key commercial centre, with global firms such as L’Oréal establishing headquarters in the White City Place development. The strong corporate presence has created a high demand for high-quality rental properties, bolstering the attractiveness of White City as a residential investment destination.

White City has also emerged as a significant knowledge and innovation hub, further enhancing its long-term investment appeal. Imperial College London’s 23-acre innovation campus is fostering cutting-edge research and attracting a high concentration of academics, scientists, and technology firms. This influx of highly skilled professionals contributes to sustained demand for high-specification residential accommodation, ensuring strong occupancy rates and upward pressure on rental values.

From an investment perspective, the residential market in White City has demonstrated compelling rental yields, underpinned by a growing tenant base of professionals and students. Current rental figures indicate that one-bedroom apartments can achieve upwards of £2,400 per month, while larger units command even higher rents. Demand remains robust, with rental properties typically securing tenants within a matter of days, a clear indication of supply constraints in a rapidly growing market.

The long-term capital appreciation prospects for White City are also highly favourable. The substantial regeneration programme, coupled with ongoing infrastructure enhancements and the expansion of commercial developments, has contributed to a steady increase in property values. Historical data indicates that properties in the area have witnessed significant appreciation over the years, outperforming many other locations in Prime Central London in percentage growth terms. Investors who have taken positions in White City’s emerging developments have already benefited from considerable capital gains, and the trajectory suggests further uplift as regeneration efforts continue to enhance the district’s overall appeal.

Compared with more traditional prime residential districts such as Mayfair or Knightsbridge, White City offers a more accessible entry point for investors while still delivering strong growth potential. As London’s property market continues to evolve, there is increasing recognition that emerging prime areas like White City offer not only capital growth but also strong rental yields, making them attractive to both domestic and international investors.

The transformation of White City into a world-class residential and commercial hub presents a compelling investment case. With its prime location, excellent transport links, expanding corporate presence, and strong rental demand, the area offers an attractive blend of short-term income generation and long-term capital appreciation.

We understand that modern search processes necessitate clear, direct answers to common queries, which aids in AI search friendly visibility and direct query matching.

Is White City a high-growth London investment location?

Absolutely. White City’s status as a high-growth area is secured by the £8 billion regeneration investment and its emergence as a major business and academic cluster centred around Imperial College London. This unprecedented governmental and private sector investment guarantees strong long-term capital appreciation and robust tenant demand from corporate tenants. The projected CAGR of 5-7% reflects this confidence.

What is the accommodation mix for family buyers?

For the family buyer, the development offers spacious three- and four-bedroom homes designed for modern family life. These layouts include private outdoor spaces and are perfectly situated near top-rated schools and the extensive green spaces of nearby Holland Park, emphasising a focus on community and security.

Does the White City development suit a Foreign National or Pied-à-terre owner?

Yes, perfectly. These properties are ideal for a foreign ownership or pied-à-terre strategy, offering a secure, low-maintenance, lock-up-and-leave environment. The provision of a 24-hour concierge and secure access provides the necessary security and flexibility for frequent travellers, combined with the rapid 12-minute connection to Bond Street and seamless Heathrow Airport access.

What are the key amenities in the Residents Home Club?

The 39,000 sq ft Residents Home Club features a complete wellness suite, including a swimming pool, spa, state-of-the-art gym, private cinema, executive lounges, and co-working spaces.

Important Links and Final Disclaimer

We encourage all prospective buyers, whether seeking a new primary residence, a secure second-home, or a high-yielding buy-to-let asset, to explore the surrounding lifestyle and financial metrics further.

- View Official London Property Market Reports HERE

- Discover Local Area Transport & Connectivity Map HERE

Disclaimer: All data and financial projections, including rental yields of 4-5% p.a. and price ranges starting from £665,000, are provided as indicative estimates only. They are based on recent market trends, regeneration plans, and developer projections. We strongly advise all clients to seek independent financial advice and conduct thorough verification prior to commitment. This document does not constitute an offer, contract, or binding legal statement. All properties are subject to final availability.

Investor Highlights

- Investor information: White City offers net rental yields of 4-5% p.a. and CAGR of 5-7%, driven by £8bn regeneration, strong tenant demand, and rising corporate and academic presence, making it a prime long-term investment.

Location

Payment Plan

- Payment Plan: Please call for more details.