Global Financial Epicentre, Ultra-Low Residential Supply, and Timeless Prestige.

The City of London represents a unique investment class: the world’s most concentrated financial district with critically limited residential supply. It attracts ultra-high-net-worth professionals, international executives, and those seeking the ultimate in accessibility to global markets.

Investment here is driven by capital preservation, exceptionally high rental rates per square foot, and demand from highly affluent corporate tenants. Assets are modern, high-specification apartments often located within architectural masterpieces, offering stable value insulated by historical scarcity and global corporate presence.

Investor Highlights: The City of London Metrics (EC1/EC2/EC3/EC4 Residential)

Data snapshot illustrating the capital density and key performance indicators in the Square Mile.

| Metric | Detail | Implication | Investment Focus |

|---|---|---|---|

| Average Unit Price (2-Bed Apt) | £1,500,000 – £4,000,000+ | Premium pricing justified by proximity to the financial district and exclusivity of location. | Capital Preservation |

| Gross Rental Yield (Indicative) | 3.0% – 4.5% | Lower headline yield but extremely high Rent per Square Foot due to professional density. | Income Quality |

| Capital Growth Driver | Ultra-Limited Supply & Global Corporate Demand | Residential development is strictly constrained, guaranteeing sustained high demand against fixed supply. | Scarcity Value |

| Tenant Profile Dominance | UHNW Executives, International Corporate Serviced Apartments | Tenants are primarily senior executives paying premium for walk-to-work convenience. | Tenant Affluence |

Asset Character: High-Spec Modernity and Architectural Heritage

The Value of Modern Development and Lifestyle

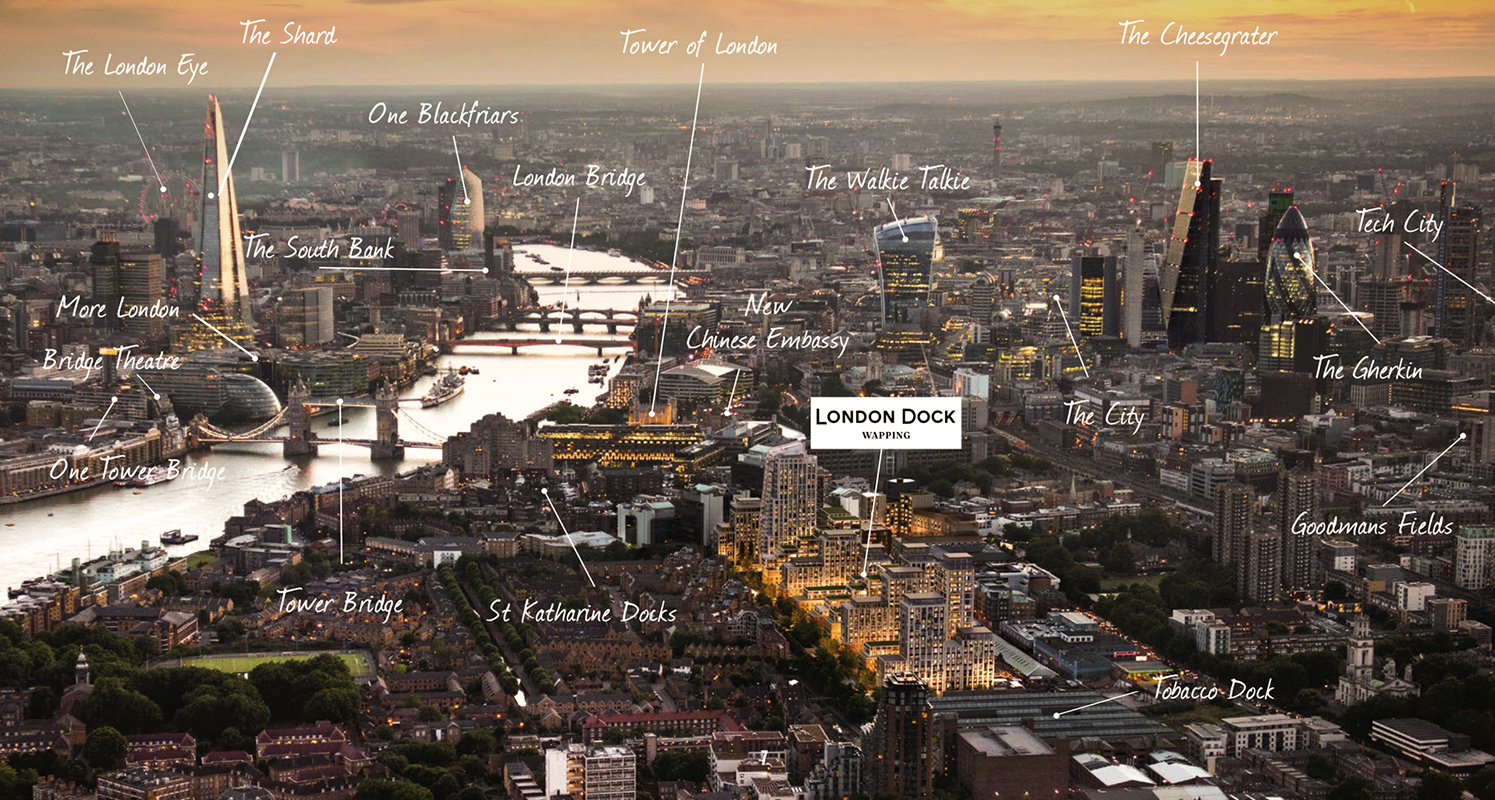

Residential assets within the City are concentrated around key hubs like Barbican, Tower Hill, and the Moorgate/Liverpool Street Crossrail corridor. These properties are typically defined by:

- Exclusive Facilities: 24-hour concierge, private spas, residents’ business lounges, and high-level security.

- Architectural Integration: Properties often sit within or adjacent to iconic financial landmarks (The Gherkin, The Shard, Walkie Talkie).

- Superior Specification: The residential stock is almost exclusively high-spec new-build or meticulously renovated period warehouse conversions.

The strategic scarcity of land and continuous global corporate investment ensure that residential value in the City acts as a bellwether for prime London, offering exceptional resilience.

Historic and Cultural Appeal

The City’s history, spanning two millennia, adds an irreplaceable cultural dimension to its residential offering. Tenants appreciate the proximity to:

- The Bank of England and the Royal Exchange.

- St. Paul’s Cathedral and the Tower of London.

- Premium cultural amenities, including the Barbican Centre and the Museum of London.

This commitment to historic prestige and modern convenience is fundamental to securing premium, long-term tenancy from the highest tier of the global workforce.

Connectivity and Global Access: London’s Transport Nexus

Crossrail and Tube Excellence

The City benefits from the highest density of transport connections in the capital, making it uniquely efficient for domestic and international travel. Key hubs include:

- Bank/Monument: Direct access to 5 Tube lines (Central, Northern, Waterloo & City, District, Circle) and the DLR.

- Liverpool Street / Moorgate: Major overground terminal and the pivotal link for the Elizabeth Line (Crossrail), offering rapid access to Heathrow Airport and Canary Wharf.

- Mansion House / Cannon Street: Direct routes serving the West and South of England.

This unparalleled connectivity makes The City the ultimate base for global executives, driving rental desirability that is less susceptible to local economic volatility.

The City Lifestyle: Efficiency and Exclusivity

The residential lifestyle in the Square Mile is defined by maximum efficiency and exclusivity. The City provides high-end dining, luxury retail concentrated around Cheapside and Bank, and access to unique private member’s clubs. The focus is on the ‘walk-to-work’ concept, reducing commute times to zero for tenants working in finance, law, and insurance, which is a powerful driver of sustained premium rental income.

Essential Investor Questions About The City of London

Why invest in the City over Prime Central London (PCL)?

The City offers a distinct advantage through its defined tenant pool (corporate executives) and extremely limited supply constraints, often resulting in lower volatility and more dependable, corporate-backed tenancy agreements than many PCL sub-markets. It also benefits most directly from the Elizabeth Line impact on connectivity.

Is the market over-reliant on the financial sector?

While finance is critical, the modern City also hosts major global law firms, insurance giants, and technology headquarters. Its role as a global service hub makes it resilient, attracting top talent regardless of the sector. The residential market caters to this diverse, high-earning population.

What are the typical service charges?

Service charges in City residential buildings are generally higher than average, reflecting the five-star amenities (concierge, pool, gym, managed security) and the high cost of maintaining historically significant or complex modern structures. These costs are reflected in the premium rents achieved.

What are the key residential zones?

Key zones include the Barbican (unique cultural landmark), the areas around Moorgate and Liverpool Street (for connectivity), and the Tower Hill/Aldgate fringe for high-rise, modern apartments with river or skyline views. Each zone targets slightly different segments of the corporate rental market.

*This content is an optimised narrative incorporating structured investment data and intelligence for The City of London’s residential zone.*

Invest in the Heart of Global Finance.

Request the Exclusive City of London Market Brief.

Access off-market, high-value residential opportunities in the world’s most critical financial square mile.

Contact our Prime London Team View Available Luxury Assets